The Bar-On Brief: California’s poor teacher recruitment plan

What is stronger than Hercules and impossible to get rid of like a stain of bleach? If you answered with “the teacher’s union,” you are correct.

The California legislature is in the process of debating a bill, Senate Bill (SB) 807, that would excuse teachers from paying income taxes after five years of teaching. The bill will auto-expire in 10 years.

SB 807 is an awful idea that will do significantly more harm than good if implemented.

First, let’s begin with the budget. I remember a few years ago when Governor Jerry Brown was praised for having balanced the California budget. Finally, we were in a surplus. But the most recent budget released has us at over a $1 billion deficit. What happened?

Not only that but Brown campaigned vigorously for the state to pass an extra tax to pay for deteriorating roads, costing the average driver an additional $10 a month and making California’s fuel prices the highest in the nation. And now, with a deficit and an increase in taxes, the legislature wants to exempt teachers from paying income taxes, costing the state roughly $600 million annually.

The intention is a good one, I’ll give them that. Indeed, we do need to make the teaching position more attractive to prospectives.

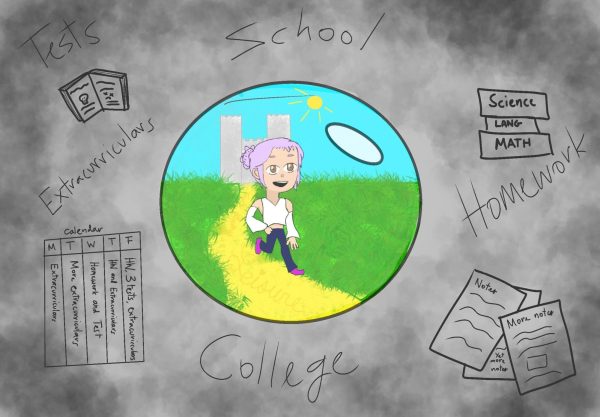

Data shows a 40 percent decrease from 2011 to 2015 in the number of students enrolled in teacher preparation courses. The decrease from 2002 to 2011 is 73 percent. This is a clear and frightening sign that the teacher recruitment system is flawed.

So A for effort on SB 807? Sadly there’s not “effort” category on my report card, so this is more like an F for implementation.

I, alongside many others, have been advocating for a tenure reform for years now, and for an increase in teacher salary. True, a decrease in teacher spending is the same as increasing salary, but there’s a key distinction: who is eligible.

It does not make sense to exempt all teachers from a “civic duty” (paying taxes) after five years when tenure is granted, on average, after two.

Good teachers deserve more pay, but unfortunately not every teacher is a good teacher. Tenure is awarded too easily, meaning that most every teacher will be eligible to write off their income taxes, losing more money for the state.

The proper way to reward adequate teachers is to award bonuses to those who do their job properly. Strong-performing teachers can be identified by school administration with student feedback and test score analysis.

Furthermore, with SB 807 set to expire in 2027, it does no good in attracting new teachers. Instead, it will deter prospective teachers planning to enter the workforce in that year.

There’s no debate that teaching is a tough profession that isn’t being given enough credit. The average starting teacher salary in a school like HHS is $45,265. Mid-career, a teacher can expect to earn $72,281, with a maximum of $94,342. Meanwhile, the average software engineer in the Valley makes $110,000.

A family needs a household income 46 percent higher compared to the rest of the nation to live comfortably in Sunnyvale, reports show. But the LA Times reports that SB807 would only add about another five percent, $3,500, to teacher’s net income. Basically, it’s pointless.

And what about other California cities like Chico, Bakersfield and Merced, where the cost of living is below that of the national average? Why should those teachers also get the tax cut?

Affordable housing plans are necessary in many cases, but those need to be handled by the cities, as they have been. San Francisco is taking that responsibility seriously, and the FUHSD Board candidates made serious promises to provide affordable housing for teachers during their terms in office.

But this proposal to cut revenue by providing a single employee group — one with an incredibly strong union — with tax cuts is absurd.

Teaching is based on the principle that every student is different, that every student must be taught in accordance, to accommodate different needs. Well, it’s the same thing with teachers. We cannot just throw money at every teacher, even though that’s what the union might like.

But a compromise to award bonuses to only the best teachers? That’s something the union should endorse.

Teachers are the single most important aspect of the education system. They can create lots of good and equally lots of bad. Safety nets and special treatment isn’t the way to better the education system. It’s a mediocre plan that will bring in, and even worse, retain, subpar, mediocre teachers.

And with that, I rest my case.

The Bar-On Brief is a weekly column that runs Thursdays.

Follow Shauli Bar-On on Twitter @shauli_baron